Taxation In Rwanda

Taxation in rwanda in this lesson we will focus on the rwanda taxation system.

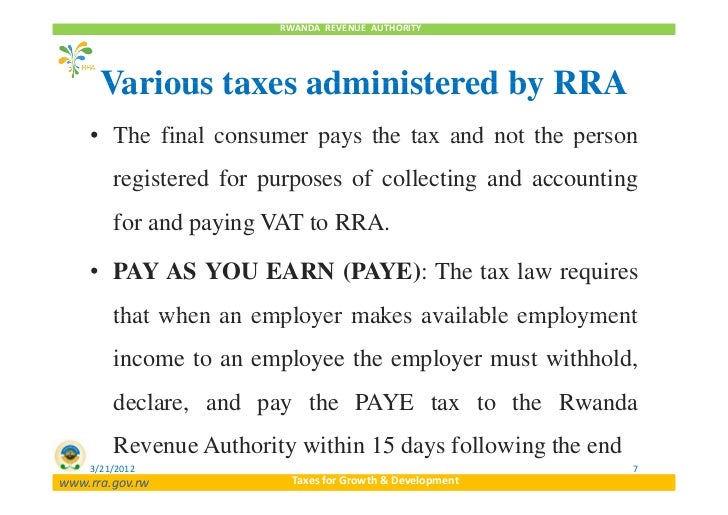

Taxation in rwanda. Rwanda s income tax alert. Income liable to tax income tax is levied in each tax period on the total income of both resident and non resident persons earning an income in rwanda. April 2018 the new law has now clarified the position to the effect that where rent of a house or motor vehicle is directly paid by an employer for an employee the amount paid will be taxed like any other allowance. The same rates of tax are applicable to both residents and non residents.

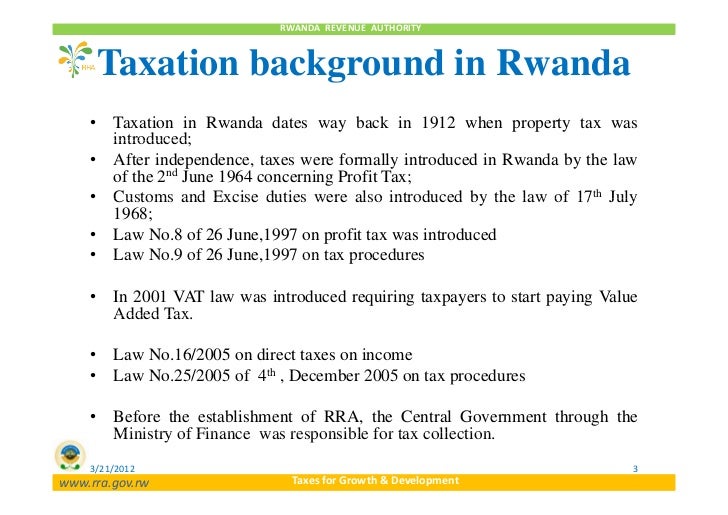

There was another ordinance on 15th november 1925 adopting and putting into application the order issued in belgian congo on 1st june 1925 establishing a profits tax the substantive law governing customs was enacted on 17th july 1968 accompanying the ministerial order of 27th july 1968. Truly speaking in the modern world taxation is used as an instrument of. A resident person must pay income tax on all income earned from domestic and foreign sources. Direct taxation includes a tax on industrial and commercial profits at 35 in 2003.

25 on the next increment up to 1 142. In other words taxation policy has some non revenue objectives. Personal income tax rate in rwanda is expected to reach 30 00 percent by the end of 2020 according to trading economics global macro models and analysts expectations. The personal income tax rate in rwanda stands at 30 percent.

Rwandan resident individuals are taxed on their worldwide income. Non residents are taxed on their rwandan sourced income. A non resident person must pay income tax only on income which has a source in rwanda. Most governmental activities must be financed by taxation.

The rwanda revenue authority rra is the governmental organization responsible for collecting taxes in rwanda. The rra relies on tax laws ministerial orders and commissioner general rules in tax administration. Only 3 was collected from personal businesses. This means that the benefit in kind is the cost the employer incurs to provide such a benefit.

15 on the next increment of income up to 685. The tax legislation has a background to the colonial regimes and the first tax legislation the ordinance of august 1912 which established graduated tax and tax on real property. In rwanda between fiscal years 2016 2017 and 2018 2019 pit accounted for approximately 24 of total tax revenue. 0 for income up to about 342.

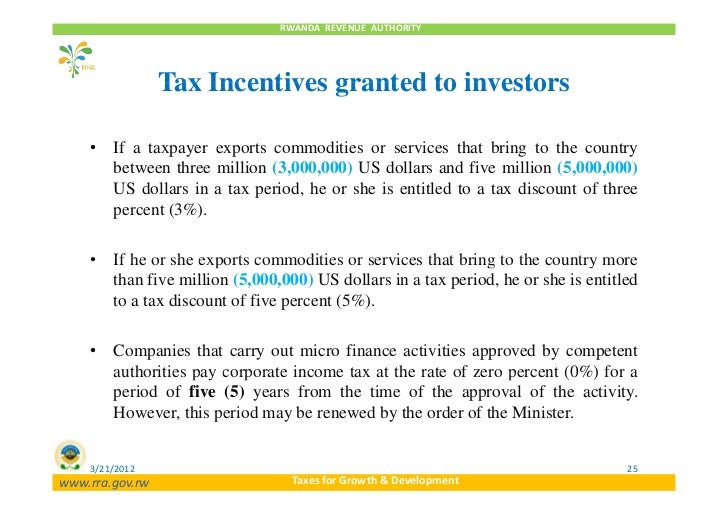

But it is not the only goal. The primary purpose of taxation is to raise revenue to meet huge public expenditure. Indirect taxation forming the bulk of government tax revenue is derived largely from import and export duties. Taxes on dividends and a turnover sales tax are also levied.